Payroll 2023 calculator

These figures derive from a players payroll salary which includes the combination of a base salary incentives any signing bonus proration. Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year.

Supremecapitalgroup On Twitter Personal Financial Management Financial Institutions Financial Management

If your EOD falls between July 1 and December 31 you will receive your increment in July 2022.

. Groceries and prescription drugs are exempt from the Ohio sales tax. As a new employer I set out to create a Payroll Calculator but in the process learned that there were too many laws and regulations associated with payroll to risk using a spreadsheet for calculating payroll. Denotes the Hawks current standing in terms of the luxury tax threshold.

Information for Michigan State Universitys Controllers Office. 2022 San Francisco Giants MLB playroll with player contracts options and future payroll commitments. Likewise if you need to estimate your yearly income tax for 2022 ie.

Pay dates are the last work day on or before the. 2022 payroll table including breakdowns of salaries bonuses incentives weekly wages and more. In the event of a conflict between the information from the Pay Rate Calculator and.

PCTY has lost ground in recent sessions although its still far from closing the gap from a price jump following its earnings report. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. Paylocity offers a suite of products to simplify payroll automate processes and manage compliance requirements.

ASCII characters only characters found on a standard US keyboard. The SAWW is the average weekly wage paid in New York State during the previous calendar year as reported. The Payroll Office is responsible for the final payroll process that issues payment advices via direct deposit and payroll checks if applicable to all regular full-time part-time and temporary employees of the Prince William County School Board.

More information on how the levy will be administered will be available later this year. The Pay Rate Calculator is not a substitute for pay calculations in the Payroll Management System. In Fiscal Year 2023 in keeping with the usual practice contractual employees may receive an increment at the employing agencys discretion.

We also offer a 2020 version. The Ohio state sales tax rate is 575 and the average OH sales tax after local surtaxes is 71. The payroll tax rate reverted to 545 on 1 July 2022.

Fall 2022 and Spring 2023. The Citys payroll system is based on the fiscal year covering the period July 1 through June 30. All payroll is processed and paid on a semi-monthly pay period schedule.

Subscribe To Newsletter. Statewide Average Weekly Wage Paid Family Leave deductions and benefits are based on the New York Statewide Average Weekly Wage SAWW. 6 to 30 characters long.

On top of a powerful payroll calculator HRmy also offers Paperless HR. Extra Service and Dual Employment Internal Revenue Services IRS Withholding Calculator Minimum wage rate. These filing rules still apply to senior citizens who are living on Social Security benefits.

The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to assisting businesses through COVID. Mileage calculation provided by the Australia Taxation Office - 78 cents per kilometre from 1 July 2022 for the 2022-2023 income year. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA.

Employment verifications may be sent to the Payroll Office 878-4124. Payroll Table 2022-2023 Contracts Active Multi-Year Salaries Free Agents 2022. I did create a Paycheck Calculator to estimate tax withholdings and calculate net take home pay.

2025 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011. 2022 EPL Salary Cap Max. An updated look at the Boston Red Sox 2023 payroll table including base pay bonuses options tax allocations.

However if Social Security is your sole source of income then you dont need to file a tax return. 2023 Payroll Deduction Calculator. Try it save time and be compliant.

Rates can be found on the Student Accounts web page. Counties and cities can charge an additional local sales tax of up to 225 for a maximum possible combined sales tax of 8. Fiscal Year 2023 beginning July 1 2022 is not a leap year.

You may be an established company in Ireland looking to quickly calculate the payroll costs in Ireland for a new branch or team or you may be looking to setup a business in Ireland in 2022 or 2023 and need a free payroll calculator for Ireland to understand how much your employment costs will be before you think about hiring someone in Ireland. 2022-23 Luxury Tax Totals. From 1 January 2023 a mental health levy will be applied to payroll tax to fund mental health and associated services.

1320 effective 12312021 Next of Kin Affidavit OSC AC934P NYS Department of Labor. If your EOD falls between January 1 and June 30 you will receive your increment in January 2023. Cash Payrolls Luxury Tax Payrolls.

Please select Full Year under the month drop down list if you would like a snapshot of Pay Schedules and Pay-dates for the whole year. Must contain at least 4 different symbols. Assessment year 2023 just do the same as previous step with your estimated 2022 total income but choose 2022 for PCB year.

Payroll Table 2022-2023 Contracts Active Multi-Year Salaries Free Agents 2022. Regional employers may be entitled to a 1 discount on the rate until 30 June 2023. If you specify you are earning 2000 per mth the calculator will provide a breakdown of earnings based on a full years salary of 24000 or 2000 x 12.

Cloud-based payroll and human resources management specialist Paylocity NASDAQ. Teams that spend over the threshold pay fines estimated below. All calculations will be based on an full years income at the rate specified.

2022 NBA Luxury Tax Threshold. Use the calculator below to estimate your payroll deductions for 2023. Kevin Huerter trade with SAC.

But instead of integrating that into a general. Use this simplified payroll deductions calculator to help you determine your net paycheck. This calculator is meant to help you estimate your tuition and fees costs FOR ONE SEMESTER.

The IRS typically requires you to file a tax return when your gross income exceeds the standard deduction for your filing status. To a maximum of 5000 business kilometres per car Deductions are. 2022 Payroll Table Active Contracts Multi-Year Spending Positional Spending Financial Summary 2023 Free Agents.

Total Taxable Salaries. Ohio has 1424 special sales tax jurisdictions with local sales taxes in addition to the state. Payroll Type Base Salary Signing Bonus USD Annual Salary Annual Salary.

QuickBooks Payroll Software helps small businesses to run and manage payroll seamlessly and hassle-free.

2

Excel Formula To Calculate Percentage Of Grand Total Excel Formula Excel Excel Tutorials

Payroll Calendar Definition How To Create And More

Payroll And Hrms Calendars University Of Minnesota Office Of Human Resources

2

2022 Biweekly Payroll Calendar Template For Small Businesses Hourly Inc

New 2022 Tamil Calendar 2023 Apk In 2022 Tamil Calendar Calendar App Calendar

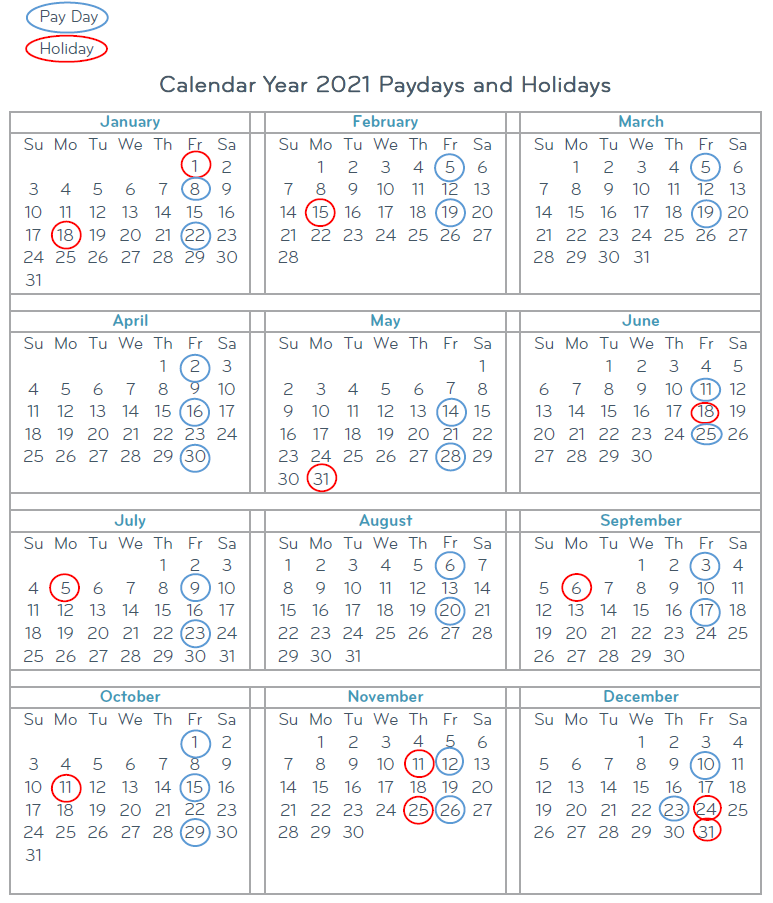

Payroll Calendar 2021 Paydays And Holidays

Comptroller General S Office Payroll Schedule South Carolina Enterprise Information System

Payroll Calculator Calculate Costs Of Hiring Staff In Latin America

Bi Weekly Schedule Template Luxury 7 Biweekly Payroll Calendar 2015 Template Payroll Calendar Payroll Calendar Template

How To Pay Payroll Taxes A Step By Step Guide

Payroll Calendar Los Angeles City Controller Ron Galperin

Bi Weekly Schedule Template Luxury 7 Biweekly Payroll Calendar 2015 Template Payroll Calendar Payroll Calendar Template

Payroll Calendar Chicago Teachers Union

Payroll Template Free Employee Payroll Template For Excel

Pay Schedule Payroll Office The University Of New Mexico